Basic Point and Figure Chart Patterns

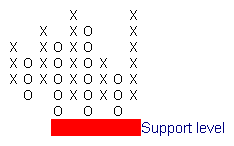

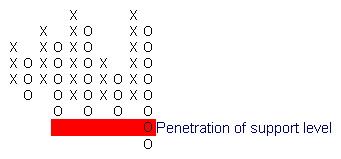

Point and Figure: Support Levels

Support levels are price levels at which large numbers of buyers are expected to enter the market. They are easily identified on Point and Figure charts by 2 or more columns of O's bottoming out at the same level.

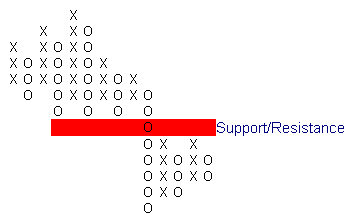

When penetrated, support levels often become resistance levels.

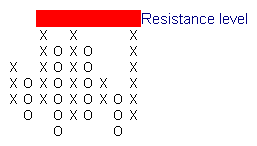

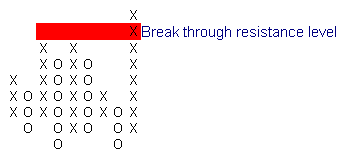

Point and Figure: Resistance Levels

Resistance levels are prices at which large numbers of sellers are expected to enter the market. You can identify them on Point and Figure charts by 2 or more columns of X's ending with equal tops.

When penetrated, resistance levels often become future support levels.

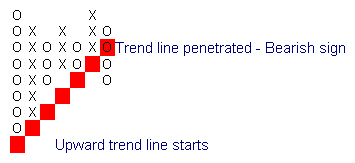

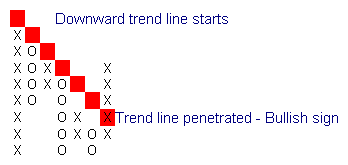

Point and Figure: Trendlines

Trend lines on Point and Figure charts are plotted at an angle of 45 degrees (one square across and one up/down).

An up-trend will always be first penetrated by a column of O's and a down-trend by a column of X's.

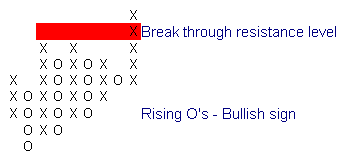

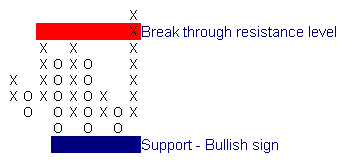

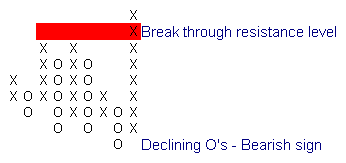

Point and Figure Breakouts

Breakout above a resistance level is a bullish signal.

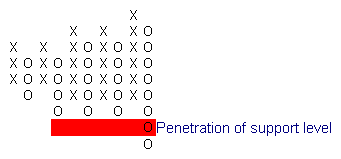

Penetration of a support level is generally bearish.

Point and Figure: Bullish and Bearish Signs

When you encounter penetration of a support or resistance level, examine the Point and Figure chart carefully for supporting evidence. The following Point and Figure pattern of rising columns of O's gives further confirmation of the breakout.

The next Point and Figure pattern shows a strong support base for the breakout — still a bullish signal.

But the next Point and Figure pattern hints of a weak breakout that may result in a bull trap.

The same Point and Figure patterns can be identified with support level penetrations. Is the following penetration of the support level likely to hold?

Rising Point and Figure columns of X's signal weakness - be on the alert for a bear trap.

Post a Comment